I was chatting with a prospective buyer about domain names and domain name valuations. This topic is a bit murky, especially when my rationale for pricing is based on select comps, my knowledge of domain names, and “my gut feel.” Although I am not willing to move on my valuation, I can commiserate with the prospect a bit because of the lack of clarity involving domain name valuations.

On a phone call yesterday, he asked me, “what do you think about GoDaddy’s appraisals?” I immediately knew why he was asking – my domain name is priced substantially higher than the GoDaddy automated appraisal. In fact, someone else had submitted an offer to me within the last year and the message field simply had a link to the GoDaddy appraisal for the name (sidenote: don’t do that). I briefly explained the automated nature of their appraisals, but I thought it would be more effective to illustrate the discrepancy of valuation vs. pricing by GoDaddy itself.

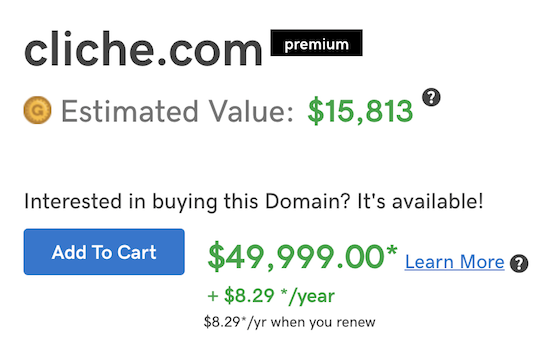

I explained how GoDaddy has acquired some domain portfolios over the past few years, and the company operates a portfolio company called NameFind. I then shared a domain name owned by GoDaddy / NameFind. For the sake of keeping the name I shared private for a couple of reasons, I will use a different but similar example. Cliche.com, for example, is priced at $49,999, but GoDaddy’s automated appraisal says the domain name is worth $15,813.

This didn’t perfectly align with my domain name’s valuation or my six figure asking price, but I used it to illustrate the fact that even though GoDaddy has its own appraisal platform, the company’s asking price doesn’t closely align with their appraisal.

On lower value domain names, the GoDaddy Appraisal tool may be helpful to domain sellers. For instance, GoDaddy lists the appraisal in the registration search channel for domain names listed via Afternic where the asking price is below the appraised value. On the higher valued names, it can be harmful to a negotiation. In my situation, it felt like the prospective buyer used the GoDaddy appraisal to almost reinforce his opinion about the value and refute my valuation.

I would love to know how GoDaddy’s brokers reply to a prospective buyer of a NameFind name who mentions the company’s own appraisal tool when the asking price is much higher.

“I would love to know how GoDaddy’s brokers reply to a prospective buyer of a NameFind name who mentions the company’s own appraisal tool when the asking price is much higher.”

I would love to know also!

GoDaddy’s domain name appraisal tool is Artificially Incompetent (AI).

What is worse is when buyers run a search on there query, and get that low number, most buyers have no clue to price a domain, but they use this tool to the wrong regard. If I was buying a domain clueless, and a tool told me $2,000, and you came back at $25,000, I would tend to side that you are crazy. We would never be able to paying double the estimate.

The tool kills more deals than it helps.

I have had GoDaddy appraisals derail about 3 prospective sales so far. The appraisals are trash and are only there apparently to drive up auction revenue which is far from end user value and 99% a fraction of what the valuation should be.

Also, pretty much any random crap you enter with two words will be valued between $500-$2000, even if it has zero value.

I simply reply, “Well, good for GoDaddy! Alas, GoDaddy does not own the domain name. I do, and I would never part with ____.com for anything less than $25,000 USD.”

If Godaddy won’t price their own inventory in line with their appraised amount then why would any other seller have confidence in it?

They are about as accurate as Zillow is with their appraisals.

The appraisals are based on an aggregate of how low someone else (+ 2-5 others) was/were willing to sell similar (and sometimes, quite dissimilar) domain names. People who buy and flip are often domain-mindset-myopic in their valuations, not understanding true impact in a particular market of having that keyword domain. So a host of factors go into pricing for those individuals that have nothing to do with actual value. A flipper in India or New Jersey, for example might be willing to sell a domain they got for 99cents on a GoDaddy promo for $350 and be quite pleased, because they have concert tickets they want to buy for next month. Another person who bought a domain for $4500 3 years ago, might sell it for $1800 because his wife or her husband needs an emergency root canal. And on and on it goes. So domains are “valuated” largely on the basis of comparative sales. I see zero appraisal automators who ever take into account the actual market factors to valuate a keyword domain. (Brand/coined domains are a little bit more subjective, though.)

I look at the size of a market, the price point of common products or services in those markets related specifically to that domain, the competitiveness in that market, the cost of acquisition of a new customer, whether customers are typically a one off buyer, or if they provide recurring revenue or a lifetime value LTV with many cross products, the conversion rate of inbound traffic, the typical on-ramp for a customer life cycle, slim or healthy margins, the intrinsic value of perceived leadership in owning a category-defining domain, number of exact searches of the term per month, the cost of advertising for that term per click, etc. In other words I valuate the impact this domain could have on a business in its own marketplace. My background is business analysis and market analysis and creating life changing solutions for corporations with household names. Domain investing came in the 90’s, 15 years later with extensive market wins under my belt for large corporations, so I never looked at domains as from a domain industry mindset. I routinely sell domains in a different stratosphere that auto-appraisers, but you have to be patient and wait for the right buyer who gets it.

I could give a thousand examples out of my own portfolio. I just ran EngagementRingDiamonds.com through Godaddy. They appraise it at $1,125. Comparable domains sold:jewelrydiamonds.com $2,188, jewelrysterlingsilver.com $1,000, weddingdiamonds.com $700. That’s how they look at domains. I, on the other hand, look at the market. Global diamond sales are $74.2 billion per year. Engagement rings and wedding bands are 30% of that market. The average price of an engagement ring diamond last time I checked was $5800. There is a huge emotional commitment to this purchase, and people often splurge well outside of a typical jewelry purchase or a normal budget because of the emotions around it. DomainIndex.com says the exact search term gets 113,125 searches per month across Google, Yahoo and Bing search engines at $3.24 CPC. If the new owner of the domain could get ranked, and convert only 3% of that amount of search volume, they would have over $10M /month in sales. Margins are slim and competition is huge. Gaining a market advantage from a keyword domain could be a game changer in the diamond business, especially to a smaller company trying to compete with the established market leaders. If I had a good reliable source myself for genuine diamonds, I would build it and rank it myself, but in lieu of that, it’s not leaving my hands for less than mid to high six figures. Compare that to GoDaddy’s $1,125 appraisal, Estibot’s $680 appraisal, DomainIndex’s $175,000 appraisal. Because I know what I’m doing, and because I understand business and markets, and because I’ve successfully executed this model for domain pricing over and over for two decades, I don’t care one iota what the average someone else who gets their guidance from auto appraisers thinks my domain name is worth.

I believe strongly that the automated domain appraisals, and those who sell domains for non-market related valuation criteria that feed into those appraisal algorithms, are hugely responsible for suppressing the true value of domain names, and keeping the market down below where it should be. Fixing this artificial suppression of domain values in the market could go a long way to a healthier view of the market assets that keyword domain names truly provide.

~ Tasha Kidd, CorporationDomains.com

zero such thing…

I broker a lot of low value (xxx – xxxx) deals. For low value domains, it’s not bad. It’s not too far off from my own pricing. I think because it uses comparables to determine pricing, it’s probably not going to align with your high value/end-user domain pricing.

sorry but who searches for Engagement Ring Diamonds? what tosh