When I set my prices for domain names I am looking to sell, it is more of an art than a science. There are a number of considerations I balance to set prices on my domain names. Here are some of the factors that I consider as I am setting prices:

- Purchase price

- Comparable sales

- Comparable domain names for sale

- Market conditions

- My business conditions

- GoDaddy appraisal on listings that will show the appraised value

- Gut feel

After evaluating all of these factors – some more than others, I set the price for each domain name. Most of these factors are considered very rapidly, and I often defer to gut feel above all else, thinking, what can I imagine an end user paying to buy this domain name in a reasonable amount of time?

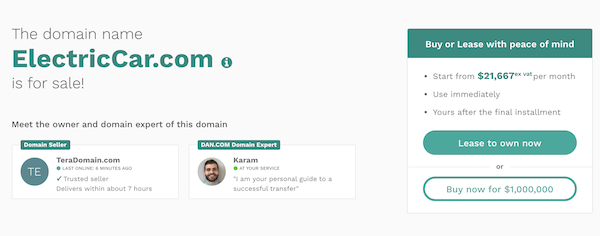

For those who list their domain names on DAN.com and allow buyers to pay with the lease to own installment plan offering that was introduced earlier this year, deciding on a price is a critical step to selling a domain name. When a buyer encounters a domain name for sale at DAN, they see two purchase options – the BIN price or a much lower installment plan price:

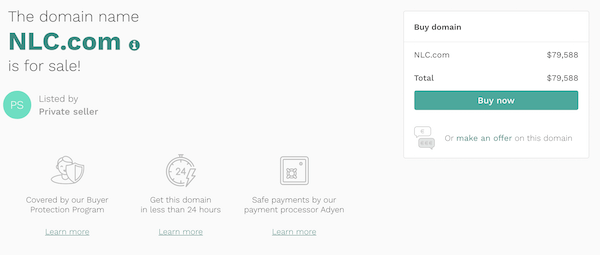

Buyers are not able to make offers on domain names with the new lease to own option as they can do with domain names that simply have a BIN price showing with a make offer option. On domain names I have listed for sale on DAN, I have a BIN price and I allow people to submit offers above a certain price level for each domain name:

If a seller over-prices a domain name with the lease to own option, they may miss out on a lead. If sellers are going for home runs with their prices, a buyer may simply choose something else if a payment plan is not of interest. For instance, if I arbitrarily list a one word .com for $250,000 but I could realistically sell it for $50,000, the prospective buyer can’t submit an offer unless they go off-site and send an email using the Whois records. There is not a negotiation mechanism to make an offer on those domain names.

I exchanged emails with Reza Sardeha, CEO of DAN, and he shared the rationale for why there is no offer option on pages with a buy it now price with lease to own option:

“Negotiations always generate more friction than portraying the buyer with a clear price point and a payment plan to make the price point affordable. Friction leads to lower

conversion rates and so fewer sales. Hence our approach to removing barriers for buyers to engage with the secondary market.”

Reza told me that the older version of the DAN payment plan option (which is still available to sellers) allowed sellers to have a BIN price, payment plan price, and an offer box. Reza told me the new version “is performing much better for our sellers on all fronts.” He further explained why the new lease to own option performs better for sellers:

“When you offer a BUY NOW price of $5000 and a Monthly acquisition price of $167 then the buyer can decide directly if they want to purchase the domain or not. This is crucial for your conversion.

While when you also add the make offer option there, the buyer will try to negotiate a total price of $2000 and then even request a monthly payment plan for the $2000. So what I’m trying to demonstrate here is that you just created additional friction by giving the buyer a third option which hurts the first two options the buyer has.”

From my perspective, which may not be the best option, having a BIN price with a make offer option opens the door for a negotiation. Even if the prospect has a much lower offer than what I would consider, it allows me to see that there is interest and I can reevaluate my pricing. Perhaps I was being overly aggressive when I set the BIN price – or perhaps market conditions have changed considerably. Even if my price is on point, I can easily pass on the offer and have a discussion with the prospect.

Pricing strategy and the psychology behind buying domain names is something that domain investors should consider when setting prices and when choosing which landing page to use.

Reza explained why the psychology behind domain name sales is crucial for domain investors:

“End-users, in general, have no idea why a domain on the secondary market should be worth more than $10. By working with BIN prices, you as the seller determine and set the price point of the domain. This is absolutely crucial in a market where there are no real metrics to value domains. We discovered that either the seller or the marketplace has to provide the buyer with the price point if you want to have a liquid and frictionless market.”

I love the option of offering recurring revenue streams, and DAN makes it super easy to initiate payment plans. I have deals in force that have monthly payments, and these funds are always appreciated. When it comes to allowing installment plans via DAN, sellers should understand that pricing strategy is important.

A simple “contact the seller” or “make offer” addition to the landing page similar to how epik has it structured would be paramount in these situations.

That’s pretty much what I thought first, but Reza shared why that might not be a great idea:

“So what I’m trying to demonstrate here is that you just created additional friction by giving the buyer a third option which hurts the first two options the buyer has.”

There is an option to contact support, on both the lander and the page after biy now or installments. There is also an option to still have a minimum bid in case negotiation does happen.

Sorry, wrong, only after a click on BIN.

How many domains you sold on this platform? ZERO, ZILCH, ZIP. Buyers don’t like this platform. Period.

As I mentioned a little over a week ago, one, in a negotiated sale: https://domaininvesting.com/my-observations-this-week/

To be fair though, I have been very slowly ramping up on the number of names I have listed there. I started in mid December with 19 names and have been slowly adding them with more added in March/April than January/February. I now have between 150-200 names.

Had I sold many more than that in the limited time I have been using DAN, it would mean my prices were too low.

Will, you are wrong. Since February 13, I have sold three domain names at BIN and four domain names on L2O with multiple payments made. The largest L2O will be for $32,500 after all payments are made.

how would you appraise or approach selling coke.party?

I don’t think it is worth anything.

Thanks Elliot for the post. Well, beside BIN, rent/lease to own option is better compared to make offer. Try and weigh the pros and cons and you will get the clear picture. Make offer in my opinion is weak, looks like you’re asking for validation from someone who knows nothing about the worth of a domain name. Rent/lease of domain names are just like the gig or sharing economy of real estate, cars/bikes, app/software, freelance, music/video sharing, p2p lending, storage/parking space, tools & equipment, etc.