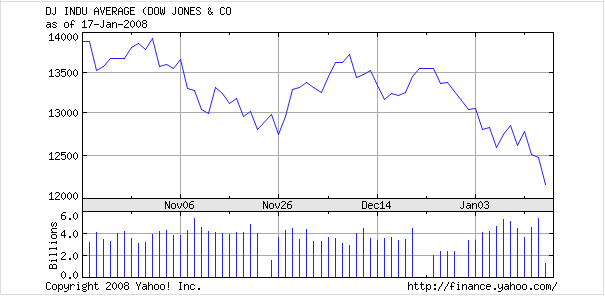

The US Dollar is weak and real estate values are dropping in most parts of the country. To make matters even worse, the stock market has been tanking of late. With the value of domain names continuing to rise, I am certainly glad to be a domain investor at this point.

Who knows how much farther real estate values will decline or how much more the market will slide, but a common sentiment among people I know is that if anyone needs to liquidate their generic names to generate cash, there are plenty of people willing to buy them at fair prices. The Internet continues to grow, people are growing their online presence, and as the economy struggles, more people will move online to make money.

I agree,

The value of domains has done nothing but go upwards for the last several years after the 1999 crash. Investing in generics and 3 characters is hot right now.

If I were a betting man I would say the “geo domains” would be a good investment too…

I’m glad I’m in the UK buying domains in dollars. It’s basically like I’m getting everything at half price. I love it, but my American girlfriend winces every time the pound gets stronger against the dollar 🙂

It would be nice if Marchex followed the domain market instead of the stock market:.)

I’m not as optimistic. I think it will flatline or drop just a tad – exactly when I’m not sure (Maybe late 2008/2009).

Until we get more end users buying our domains it is susceptible to a downward movement. And not just for that reason……

If the economy in the States tanks really bad it could hurt the amount of searches surfers do as they rein in their budgets, and consequently our bottom lines . Couple that with a current downward trend in price per click paid out to domainers , an upsurge of law suites relating to the category of “trademark” domainers, and I think we could see some stormy weather.

On a side note to the subject, it’s also my guess that many domainers are tapped out to the extreme, even though they are making good money…..b/c buying domains is an addiction. 🙂 Being cash-poor is an Achilles heel. I think the wake-up call is coming – as it does in every market. Some domainers will crash and burn, or at least have a bumpy ride when the lawsuit comes or the clicks don’t cover their “speculative portfolios”, meaning the ones that exist just to flip domains, not mainly for their income.

The caveat here, I believe, is that if some new applications arise that help domainers leverage their assets for higher earnings.

Quote:

The value of domains has done nothing but go upwards for the last several years after the 1999 crash. Investing in generics and 3 characters is hot right now.

Not to nitpick, but the crash was in 2000. 🙂

In the public mind, 2008 will be the year that cyber real estate overtakes traditional real estate for three reasons: 1) Most domain names, especially generic.coms, are undervalued while real estate is overpriced and moving downward. 2) Domain names are easier to buy/sell than real estate and 3) Most of the public is still quite ignorant about investing in domain names. There’s a lot of room to grow and expand the market. The general public has yet to jump in because of the Crash of 2000. For example, try asking your friends or relatives who know nothing about domain names if they would spend 100K for a name. Most will wince and bring us some story they heard about Pets.com, etc.

I agree with David. Just last week I offered $170,000 for a domain and was basically told “get serious” yet every non-domainer I would ever tell that story to would say “get serious” you’re an idiot. Regardless, I agree the domain was worth more…not a great idea to overpay, but my point is the market is yes liquid, but overall a very very small percentage of people even to this day grasp the value of a great ultra-premium domain.

I did pick up a great buy a month ago for $50,000 though and in that case, we were both thrilled as the seller wanted out also. Just right placem right time.

Some very good points here but I do want to make a few comments:

“The Internet continues to grow, people are growing their online presence, and as the economy struggles, more people will move online to make money.”

The internet will ALWAYS be tied to primarily two things; domain names and the internet bubble burst. That is what is embedded in the minds of most mainstream investors and money market/fund managers.

Domaining needs new money and fresh money to be a viable alternative. Swapping names and money among domainers will not keep it a liquid market although it is in much better shape than it has been. Swapping names and money will keep it afloat. But for how long if we are to weather a coming storm?

End users are paramount in making the connection between domaining and domainers. Doubtful there is not a person reading this that does not get inquiries almost daily for a domain purchase from another domainer. Every one is looking for a deal. It reminds me of the old Depression phase, “Brother, can you spare a dime?”. Today, it’s, “can you cut me a deal?”. And if you have been in this long enough, you can tell by the approach if it is another domainer making the offer of an end user.

Also, keep in mind that not all real estate is homes, rentals, condos, and flipping. It is undeveloped land and parcels. There is a tremendous amount of money going into land as there was in 2000 and during other stock market crashes. And the weakening dollar vs the EURO, GBP, and YEN makes land even a greater investment now. While recently looking at some land in Nova Scotia, I was delighted to see such a mix of buyers/investors as neighbors from Germany, England, Italy, and other European countries.

“Charles Says:

January 18th, 2008 at 12:44 pm

I’m glad I’m in the UK buying domains in dollars. It’s basically like I’m getting everything at half price.”

Amusing but so true.

That is why I am pricing everything in either GBP or Euro, a strategy that seems to be working well. Not so much from the perspective of doubling the amount desired, but to put everything on a level playing field for all.

This is what I am facing from an investor’s point of view; be it internet real estate or tangible real estate. What makes the land prospecting look so favorable from the foreign set of eyes is the weakened dollar. And with the Canadian dollar trading at about even with the US dollar, it is almost a 2 for 1 sale in prime real estate.

For those that do not think the US is already in a recession I think there will be a shock that will be more of a jolt than anything. I also invest in art, documents, and other collectibles like early southern pottery. I am seeing many high value items come to the market and realizing prices that are a fraction of what they were bringing a year ago or even 6 months ago. That tells me that the money is not out there. The bidders, buyers, and investors are holding fast. This is not a good sign for the collectibles market.

But this also means that premium will still be premium and mediocre will be mediocre…tangible and intangible property notwithstanding. Buying art and buying domain names are pretty much akin to one another. The masterpieces will not loose their value over time. The mediocre will stay steady, go up, go down, bounce, and you may have to hold onto them for a while to realize a greater ROI.

Either way, be sure you are ready to hold and ride it out, even with the masterpieces. If you are ready to put $100K into a name, your market of potential buyers may be shrinking a tad.

It is an awful lot like the housing market here in the states. When everything is priced at $350K and there is no shortage of property to choose from in that price range, then there may be a risk of having to hold onto it longer. It becomes a buyers market with many gems be passed over. Soon, because there is so much liquid assets tied into the house (domain) in order to become liquid the prices start coming down. And unlike many markets, like housing and stocks and bonds, the only ones that really seem to control the valuations of domains are domainers themselves.

And of all the people in the world, nearly 6.5 billion, how many are domainers?

As a domainer and entrepreneur and investor, now more than ever is the time to diversify.

I think these comments pretty much round up the industry and it’s direction, after all, were witnessing a massive expansion in ALL areas of the Net as we speak – and unlike the majority of industries out there it’s growing at a staggering rate. More investors and developers are coming on line, and if the real world isn’t doing so well for them “because of a recession”, then there’s going to be even more. With that in mind I don’t feel that the “forecasted” US recession will have much of an impact, in especially the domain industry.

Were dealing with identity, and with any financial market people and businesses need a placement and a pitch to survive In my view domain acquisition and sales will keep on growing vertically for decades to come.

I only wish I took domains as seriously as others back in 95 🙂