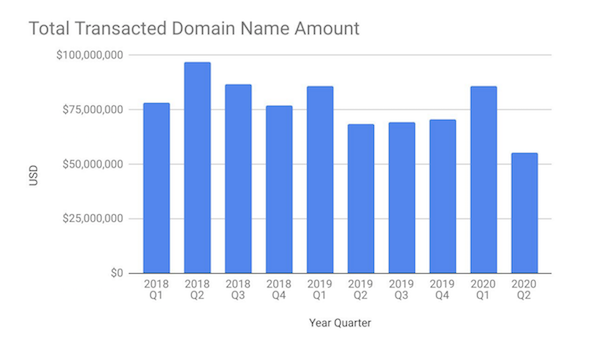

Escrow.com published and shared its Domain Investment Index for the second quarter of 2020, and the report was fairly bleak. In fact, as you can clearly see on the quarterly comparison chart on page 2, Q2 2020 had the lowest quarterly sales volume in two years, since Escrow.com began compiling the report. The full report pdf can be downloaded here, and I want to share a few thoughts about Q2.

In Q2, Escrow.com processed $55.2 million in domain name sales, down from $85.8 million in Q1. It looks like the previous low sales figures were in the high $60 to low $70 million range. Here’s a screengrab of the chart showing quarterly sales volume since 2018:

Obviously the global pandemic and related economic fallout definitely weighed heavily on domain name sales in the second quarter. Because of the pandemic, companies were buying fewer higher dollar domain names. The United States has pretty much been dealing with the worst outbreak of the Covid-19 pandemic in the world, and the sales drop in the US was most pronounced – from $70 million in domain name sales in Q1 to $42.6 million in Q2.

With the coronavirus pandemic raging or threatening, acquiring an expensive domain name became secondary to reducing cash burn and losing employees. Put simply, a company would likely have received flack if it spent $750,000 for a domain name but laid off 10 employees or took out a PPP loan.

The Escrow.com sales report looks at more than just the total sales volume in Q2. You can see some sales trends, including 2, 3, 4, and 5 letter / number sales compared to prior quarters.

All in all, the second quarter of 2020 was pretty crappy for domain name sales. Observationally, Q3 has started out pretty strong, and July will be one of the best months in terms of domain name sales revenue that I have had in several years. Hopefully, the pandemic-induced domain name slide is behind us and things continue to improve.

I don’t think it is the lack of domain sales, it is poor management and COMPETITION!!

Escrow is just a 3rd party service…..

Regards,

BullS

MBA,PhD

Magna cum laude

Graduate of Domain King Academy

MBA-My Big Ass(all of you have one)

PHD-people having dickheads

Dnjournal showed a very similar decline with a completely different dataset.

Let’s not start making up excuses because the cause is obvious, domain sales are way down.

I think some of it might be related to people transacting at DAN. I did a few deals last quarter that I would ordinarily have done via Escrow.com but chose DAN because it can be easier that way (close on the weekend and no overt KYC verification). I also would imagine some Uniregistry deals that may have gone through Escrow.com are being processed by GoDaddy.

Dan and Uniregistry took up some a chunk of their business especially in the sub $10,000 sales category.