I don’t love asking prospective buyers to make an offer to buy a domain name, particularly on higher value assets. Not only does it encourage time wasting lowball offers, it also implies that the seller is open to considering any offer, and people tend to make unrealistically low opening offers fearing a realistic offer will lead to a very high counteroffer. It can be a frustrating waste of time for all involved.

That being said, I don’t like to have “buy now” pricing for my highest value domain names. The higher end of the domain name market is dynamic, and my pricing can also vary based on my own business performance. A domain name can be priced at $175k one day and $150k or $250k the next day, depending on different factors.

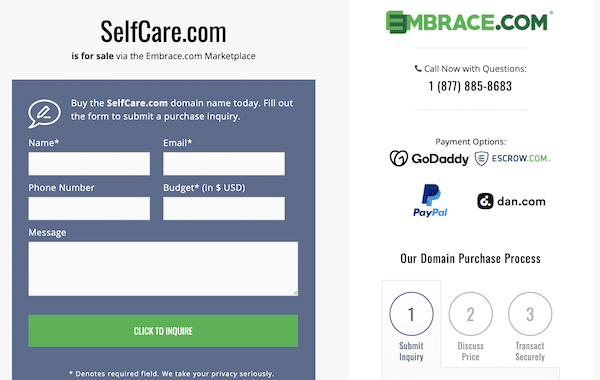

In lieu of an offer field, I now have a mandatory field for “budget” on my inquiry form. Asking for the buyer’s budget instead of an offer is a subtle but important difference. When someone is asked to provide their acquisition budget, it tells me two important things. First, it lets me know they’ve thought about what they want/expect to spend rather than just seeking information. Second, it gives me an idea if they are a serious buyer or not. I can then decide whether to engage or not.

Some prospects won’t tell me their budget. They want to keep that information close to vest. One way or another, it will come out though.

After making a change to the messaging on my landing page, I made it a requirement that people enter something into the Budget field. People can still enter something like “TBD” or $1 to get the form submitted, but the person will know this information is important to the seller.

The only downside of doing this is that there are far fewer offers and inquiries submitted. I don’t get the dopamine hit every time I hear the special inquiry/offer tone I have set on my iPhone. This would be an issue if I was using the form for inventory-quality domain names that might have more price flexibility. I don’t think a serious prospective buyer with an adequate budget won’t be put off by the form though and everyone else can go find alternative domain names.

That is a great idea. Very smart!

Interesting insights,

I took a slightly different approach

I created an appraisal table with Low Market High range and left the offer field blank

The thought is that the buyer can use the appraisal range as a guideline for their initial offer.

Does two things

1) let’s them know our likely acceptable price

2) provides them an opportunity to submit a number in an effect create their own discount to market price.

Budget or no budget,who cares

Just show me the money and buy the damn domain or just shit up