I was texting with Tony Peppler about an offer he was contemplating taking on a domain name he has owned for many years. Tony told me what he paid for the domain name many years ago, and while the ROI was solid, the annual return did not look as rosy. Tony shared a tool with me that he used to calculate his annual return, and I thought I would share it with readers.

The tool he showed me can be found on Calculator.net, although I am sure there are other tools you can use if you prefer. You can enter in your acquisition date, acquisition price, sale date, and sale price. When you hit the submit button, it will tell you how much you earned, the overall ROI, and your annual rate of return.

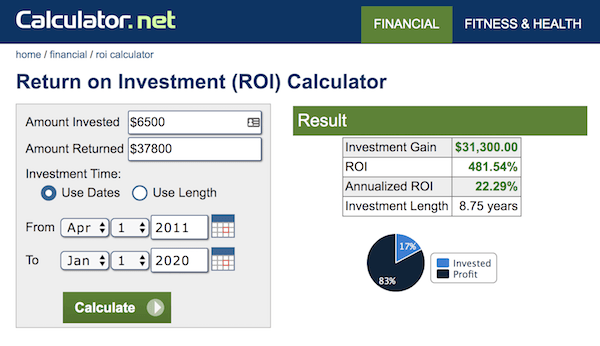

Let’s say I bought a domain name for $6,500 in April of 2011, and I sold the domain name last week for a net price of $37,800 (after fees and commissions). Here’s how that would look:

In the example above, the investment gain is $31,300 with a total ROI of 481.54%. The annual rate of return on that eight+ year investment would be 22.29%.

I don’t think the annual ROI calculation is super important, but it can help put a deal in perspective.

I think you forgot to subtract the cost of renewal fees over the 9 years of domain ownership. That will slightly reduce both the investment gain and ROI I believe.

“net price of $37,800 (after fees and commissions)”

In my example, the actual sale price would have been higher. I mentioned that $37,800 is net price, which takes the fees (renewal fees, escrow fee, commission…etc.) into consideration.

In general though, people should consider their renewal fees, especially on lower end deals where the $10/year fee would have a greater impact.

I think the annual return can be hugely important because it’s a great metric to consider the opportunity costs of alternative investments:

CD 0%

Savings account 2%

Bonds 3-5%

TDA 7%

Diversified market 5-10%

Paying off credit cards or other loans 5-15%

Riskier investments…

An annual return keeps these comparisons apples to apples.

Yeah, it is good to look at this, especially when evaluating a group of sales, to make sure you’re on track.

We you manage your OWN domains, Annualized ROI is not that important as sometimes you want to cash out a investment to purchase new assets.

Though we are in a different position. When you have to justify investments people make, the overall annualized ROI is huge for the reason Matt has shown, if we could only do returns of 5-10% when would anyone want to invest with us.

For us a Annual ROI of under 25% has to be the exception not the rule, or the investors would pull their assets from us.

Elliot is successful on his own and looks at deals differently, though if ALL his deals were under 8% then he would have to ask himself, I could get that passively 8-10% why am I working on domains 🙂 so therefore i know Elliot isn’t getting low Annual ROI. LOL!

I’m not sure what value ROI has when looking at any one sale in the context of a portfolio that accrues costs over time. I can see the value of calculating ROI on an entire portfolio year to year.

https://www.cnbc.com/2019/12/23/netflix-was-the-top-stock-of-the-decade-delivering-over-4000percent-return.html

Netflix 2010 to end of 2019 for a comp

https://www.calculator.net/roi-calculator.html?beginbalance=1000000&endbalance=43000000&investmenttime=date&investmentlength=2.5&beginbalanceday=01%2F01%2F2010&endbalanceday=12%2F31%2F2019&ctype=1&x=73&y=14

It is pretty irrelevant in my view view other than perhaps when considering whether domain investing is worth doing or not compared to other opportunities. In that case people need to account for the the time put in as well, as buying/selling names is not comparable to passive investing. It is a business with renewals and the initial purchase being a portion of the real cost.

The calculation isn’t going to help anyone make a good choice when selling because the calculation has nothing to do with domain value.

how to reach you for some domain?