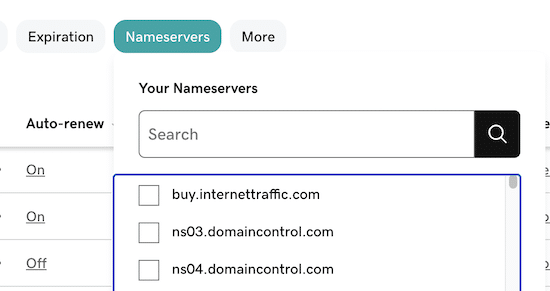

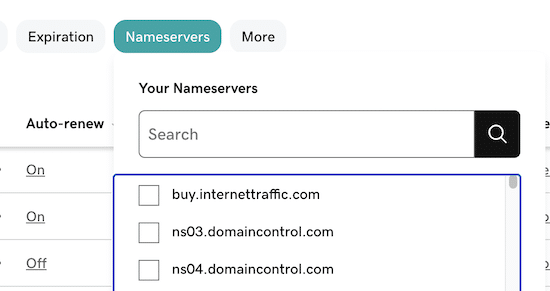

In my GoDaddy control panel, I have the ability to search for domain names based on their current nameservers. One thing I do from time to time – and should do more often – is look through the nameservers to ensure nothing stands out as incorrect.

The other day, I was looking for domain names parked on specific nameservers so I could make an update. When I clicked the nameserver search button at GoDaddy, I noticed quite a few nameservers I did not recognize as being set by me. In addition, some were very old nameservers I haven’t used in a long time (like Moniker DNS).

After a few seconds, I realized the unrecognized nameservers were connected to domain names I won at auction at domain registrars I don’t use. Instead of managing the domain names there for any time, I had immediately transferred them to my GoDaddy account. For whatever reason, I neglected to update the nameservers. This was an own-goal for me, but I am glad I caught the error and updated the domain names. The domain names set to Moniker nameservers are two personal domain names I previously used for forwarding but now keep just because.

Searching for domain names by nameserver is something I plan to do every so often. I don’t have enough names that this will ever become a major issue, but it’s such a simple search that I might as well do it every so often just to be sure nothing slipped through the cracks.

I have to assume other registrars have similar search functionality, so this could apply to people who use other domain registrars.