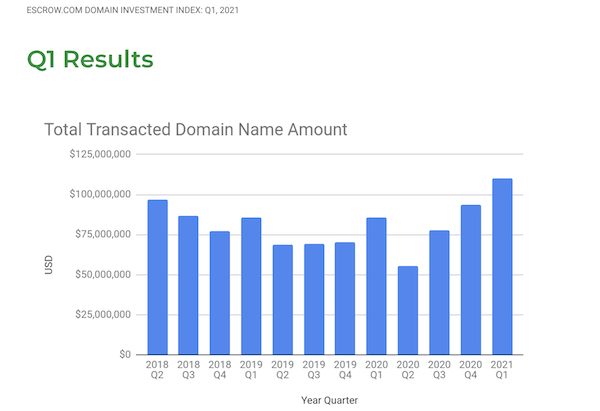

Escrow.com has released its Q1 2021 Domain Investment Index report with domain name sales data from the first quarter. The high level overview is that “the market for domain names is stronger than ever.” Escrow.com handles a significant percentage of higher value domain name sales, and I believe their data offers a good look at the health of the domain name aftermarket.

Some of the highlights from the report that were shared with me include the following:

- Q1 2021 trading volume was led by sales of a record number of large domain name portfolios as well as sales of high value individual domain names. As large businesses continue to invest in their digital-first sales channels and online branding, 2021 is looking to set a new high-water mark for the domain name aftermarket.

- Total domain name transaction amount continues to increase its upward trend from Q4 2020, ending at $110m in Q1 2021.

- Majority of the surge remains to be involving a party residing within the US where volume increased from $77.9 million to $89.6 million.

- Median price returns compared to Q4-2020 at 16.67% is relatively smaller this time around however at 2.8% in Q1-2021. Meanwhile, compared to Q1-2020, the median price returns for Q1-2021 is at 24.67%.

I am not an economist, but I believe there are many factors contributing to the growth seen in the domain name aftermarket. There has been a considerable amount of government money that has been pushed into the economy. Startup funding and general business funding has increased tremendously, and that additional capital has driven domain name acquisitions. Further, the growth of the cryptocurrency economy has driven some capital flow into domain name assets as well.

You can visit Escrow.com to download the report pdf and see the full report for yourself.

Stocks–Microsoft,Starbucks, and my darlings Amazon and Tesla—love them all –thank you thank you

all of them have splits 5 times…and bought them all below $30. FYI-AMAZON gonna spilt again.

I know lots of folks working for Amazon,Starbucks,Microsoft during the 90ish…..

Real estate-bought my house in 1993 at $125K and now worth 1000%—Insane–a 2 bedroom 1 bath sold for $850K!!! and then got demolished and rebuilt for a bigger house….

Domains–thank you–easy peasy hobby, started in 1999

it is all ABOUT TIMING AND LUCK…..you don’t need MBA or any high powered degree, it is all about common sense

***MBA-my BIG ASS