A few years ago, I wrote about domain names being offered up on Rally, “a platform for buying & selling equity shares in collectible assets.” It looks like the company offered fractional ownership in at least two domain names that I can see – HotSpot.com and Directions.com.

HotSpot.com currently has a $136,500 “market cap” and Directions.com has a $68,600 “market cap” on the platform. I am not familiar with the platform, but it looks like both domain names are trading for less than when shares were first available on the platform.

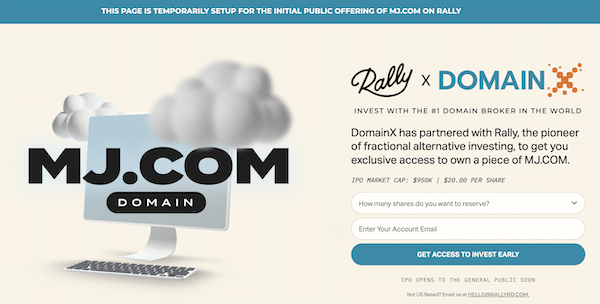

It looks like another **high** powered domain name is going to be offered up for fractionalization on Rally. According to the Media Options newsletter today, MJ.com is going to be offered up with an “IPO Market Cap” of $950,000. The offering information can be found visiting MJ.com directly. Andrew Rosener, CEO of Media Options, previously discussed his relationship with Rally back in early 2022.

I am not very familiar with Rally nor am I familiar with the intricacies of buying shares in collectibles or owning fractional shares of domain names, so you’ll need to do your own homework to get an understanding of that before participating. I do know domain names and MJ.com is a great asset that can be used in many ways.

It is nice to see domain names offered up on a marketplace like this which also has many types of collectibles listed.

No one – not a single person – made money on any of these offerings except the people selling this investment.

Not a single domain name on Rally has ever traded for one penny above its initial offering price.

And why would they? The domain registrant gets a pile of cash for nothing, and has a reduced incentive to sell the domain name. The shareholders have no decisionmaking power whatsoever and, frankly, what is it they were looking to make?