I wrote about Uniregistry’s Domain Liquidity initiative last week. I shared that I like the idea of the program even though the exact details about how it will work are a bit sparse right now. I decided to try out Domain Liquidity to see how it works and share my results with you. The program is in its beta phase, and I think this has the potential to be a positive for domain investors.

I wrote about Uniregistry’s Domain Liquidity initiative last week. I shared that I like the idea of the program even though the exact details about how it will work are a bit sparse right now. I decided to try out Domain Liquidity to see how it works and share my results with you. The program is in its beta phase, and I think this has the potential to be a positive for domain investors.

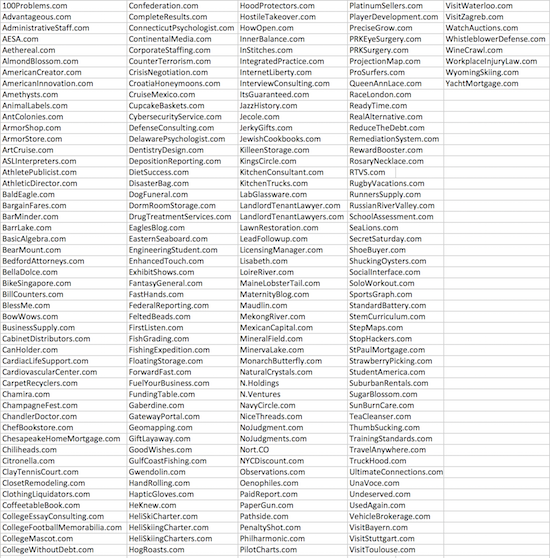

I submitted a list of 208 domain names for review. (I posted the list in a screenshot below). There were a few one word .com domain names, a couple of .CO domain names, a couple of new gTLD domain names, and plenty of 2 and 3 word .com domain names. I wanted the list to be diverse to really get an idea of the types of domain names that were of interest and the offers for each of them. I don’t really want/need to sell inventory for wholesale prices right now, but I was open to sell if the offers were good enough, and also importantly, I would learn more about this initiative.

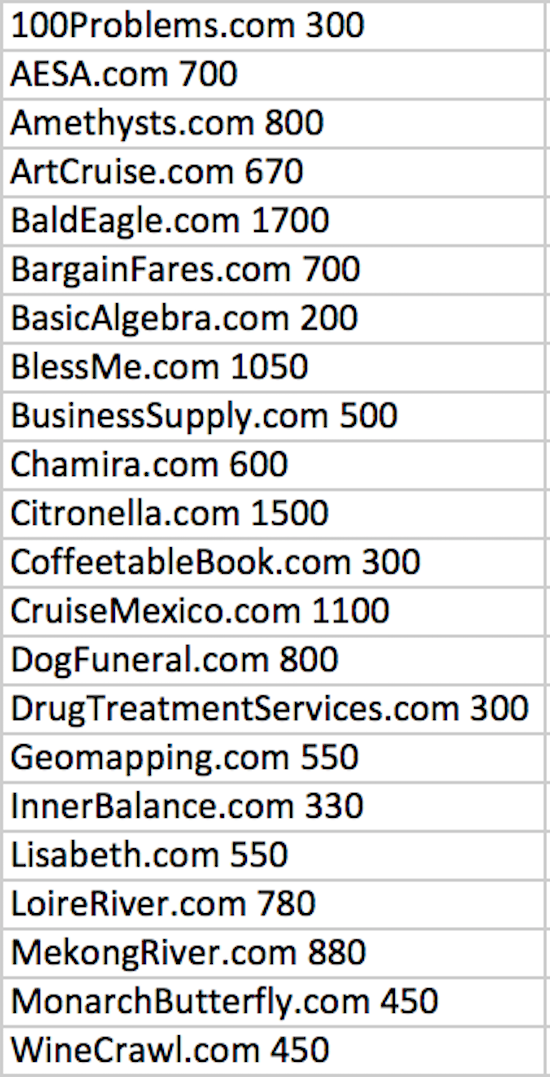

Within thirty minutes of submitting my list, I had a reply with individual offers for 22 of my domain names. The majority of the offers were not great and some far below what I paid. Several were offers I would consider reasonable and on par (or maybe even better) than what I would expect to get from an auction.

After exchanging emails with Frank, I learned that I can’t simply pick and choose individual offers to accept. If I don’t want to sell all 22 domain names that received an offer, I would have to negotiate with the buyer to come up with a deal for a partial list. Frank told me everything is negotiable between the two parties though. The reason a seller can’t just cherry pick names without the buyer’s approval is because some buyers don’t want to mess around with very small deals. This is understandable. I have closed fewer than five private sales in the last 5 years that were less than 4 figures because they aren’t worth the effort. I imagine it would be easier to negotiate a bulk deal for the entire lot, but we were too far off in valuation for me to consider that option.

In the end, I told Frank I would be willing to sell five of the domain names for the offer price, totaling a bit more than $4,000. Frank agreed to my proposal shortly thereafter, and we are moving forward with our deal.

Frank told me there is no commission being charged at this time because Domain Liquidity is still in its beta phase. I assume that will change when more buyers are onboarded. Once a commission is charged for successful deals, I believe better offers due to the added competition amongst buyers could offset commission fees.

Some people might complain about the low offers. Personally, I don’t care nor do I get offended by low offers. The buyers are looking for deals just as I am. If I don’t like the offers, I do not have to accept them. People should also realize a list of 500 crappy domain names will probably not get any offers no matter how many buyers there are.

Uniregistry expects to have more buyers onboarded in the near future. As buyers are onboarded, I imagine offers will improve as it becomes more competitive to buy. Imagine if NameFind, HugeDomains, and other very large wholesale buyers participate to bid on names. Buyers will be competing to acquire the best of the submitted inventory, and I presume offers will rise with the competition.

One change I think would be beneficial is to allow buyers to make their best offers on individual domain names, and those offers are returned to the sellers to review. Sellers could accept or reject the individual best offers as they wish. This would be almost like an auction but without the auction time period. Assuming individual buyers are vetted for solvency before participating, the seller would be less concerned about a deal not getting funded. I am not sure how well this can work at scale, but I think it is worth exploring.

Domain Liquidity is in its infancy right now. I think this has the potential to be very helpful to domain investors looking for quick liquidity vs. other options. I am happy with the outcome of my negotiation.

Submitted List:

Offers Received:

Disclosure: I told Frank in advance I was going to share my submitted list and offers with readers so they can see how it works and what types of offers are being made.

Thanks for sharing!

What 5 domains were sold?

How long did it take to get a reply from Uniregistry?

30 minutes or so for the initial offer. Been emailing with Frank on and off for several days though – mostly seeking answers to questions about the initiative rather than trying to get a deal done. I was a bit confused about whether it was an all or nothing type of offer but he clarified this for me earlier today.

Thanks Elliot. 30 minutes is a pretty good turnaround time considering they’re probably getting bombarded these days

(And thanks for replying to my comment even though it was buried under someone else’s…fat fingers and a smartphone don’t always mix)

Sorry, I’m going to keep that private out of respect for the buyer.

Hi Ellilot. I am trying to figure out why you suggest buyers being able to make bids on individual domain names? Isn’t that what you ended up with in the end? You offered 5 for a certain price and they were accepted?

I had to negotiate that. The buyer could have said no to a smaller deal. It would be great if the buyer could simply agree to smaller deals.

This might be annoying for buyers at first, but if they were buying at scale, it would be less annoying

Thanks Elliot for sharing all the details…

Very helpful to others.

Thank you for sharing. I scanned the list and didn’t see any that I would want to own because I don’t foresee corporate buyers like CEOs or CMOs wanting to buy them for their businesses. In that context, I felt Uni’s offers were pretty good offers.

Just to be clear, my motivation was to learn more about the program to share in a blog post rather than to sell domain names.

To that end, I am not interested in selling any of these domain names for wholesale prices to readers.

It’s kind of like the disclaimer they show at the end of Shark Tank – no solicitation is being made to viewers here.

BaldEagle.com is a nice name

How was payment executed and protection for both parties? If PayPal it’s risky if you don’t who the buyer is. How long did transfers take and payment received?

Those are good questions for the next iteration when third party buyers are on-boarded, but I do not know. I presume payments would be similar to how payments for Marketplace sales are processed but I do not use Uniregistry for brokered sales.

Uniregistry pays me via PayPal for parking so that would be fine as would a direct wire. We just agreed to a deal this afternoon, so payment has not yet been sent. He has the auth codes to transfer the names to Uni though. Not worried about using escrow with Frank/Uni. He’s good for it in my book.

When your domains are sold, Uni will pay you and the domains are transferred to Uni’s account.

It is between Uni and the buyer…

I parked most of my domains at Uni and I love the user friendly dashboard.

Nice post. I think this is a great feature to have as some people, many people often need liquidity and this is a way to do that. Frank always innovating!

With an offer coming back that fast I’m wondering if it was Frank that was the buyer. Not that it matters, but curious.

I am pretty sure it is.

This post has some good in it.

But, it is far from the ideal experience regular domainers are likely to experience. It is not scientific, so to speak; it is not a real market activity, where buyer and seller, randomly performed.

This is a situation where a “nice guy” blogger, called up his pal, to make a deal happen, so it could be written in a blog.

Simple.

While reluctant to rain on a useful post, and a useful site, I have to agree with domenclature. This article motivated me to give it a try with a list I believe to be similar to Elliot’s. A month later and no reply. Not even a “thanks but no thanks.” As a long-time Uniregistry seller I am accustomed to a different experrience, but perhaps my list fell through the cracks. I have tried again and will report the results if anyone seems interested in this dated thread.

No response to date from Uniregistry.

Elliott, as usual thanks for sharing the details. I think Frank is on to something very useful and powerful. I submitted 26 names this morning, and was advised they were slammed and I would hear something back within 2-3 weeks. So obviously they have been sent many portfolios to wade through. A little like “be careful what you ask for” as I can imagine a high percentage of the names will come back with disappointing prices….not because of the marketplace, but rather owner’s expectations.

2-3 weeks, lol, if the domains are great they are going to execute. How do these two stories differ from same day to 2-3 weeks?

So this is not Frank buying for Uni, it’s an investor they referred?

I do not have an answer.

I can only share what I experienced.

Thanks Elliot for sharing your test.

Certainly due to my poor english I thought it was a full portfolio purchase service, not a bulk domain sale cherry picking service to help liquidate unwanted names or get some quick cash.

But it also has a great interest, it’s simply a different concept, and now the clarification is done then everybody can better decide to test/use the service. And yes, this should add liquidity in the domain space.

Btw I like a lot they price each name they are interested in buying, more than just give a simple price for a lot.

Definitively something I will also try.

It can certainly be improved allowing others domainers to make their best offers on domain submitted and Uni sugggest the high offers to the sellers, maybe something they have in mind in the future.

Congrats Uni.

Great Post. This could become a Big winner for everyone if they can get the platform built with lots of buyers. Similar to market makers in stocks.

Thanks for sharing Elliot. I submitted 100 good .com names because it said 100 names maximum, I guess that is not a strict rule? I received an email back pretty quick from Frank: “These are good Mark…. Would you consider $350 a name?” I respectfully declined because like Frank said they are good names. I am not sure what I was expecting but I wanted to at least see what kind of offer I would get. I think I would have preferred some cherry picking with higher offers like Elliot got. I think I might submit another batch with good names mixed with not as good names and see what happens, mix things up a bit and maybe include a few .net’s, .me’s and .tv’s. I have a 1998 .com that was not in the first list of 100 and I see Frank has the 2004 .net listed at $9800, maybe I will include that one and see if I can get an offer better than $350 lol…

Thank you for sharing your experience.

This site is such a great resource. Much appreciated!

Thanks to all who have submitted their names for the new domain liquidity program at Uniregistry. Due to overwhelming interest in the program response time may be delayed, however all submissions are taken seriously and we will do our best to review and responded to them chronologically.